Any content you receive is for information purposes only. Always conduct your own research. *Sponsored

INVO Fertility, Inc. (Nasdaq: IVF) Just Hit Market Crux's Watchlist For Tomorrow Morning—Friday, March 13, 2026.

Don't Miss The Next Breakout—Get Real-Time Alerts Sent Directly

To Your Phone. Up To 10X Faster Than Email.

Expect Our Full Coverage On (Nasdaq: IVF) To Start Early

Get (Nasdaq: IVF) On Your Radar Before Tomorrow Morning…

March 12, 2026

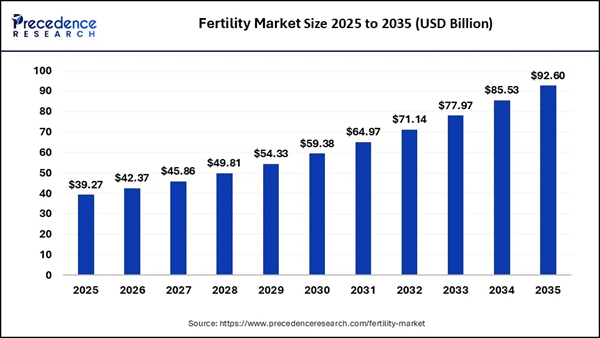

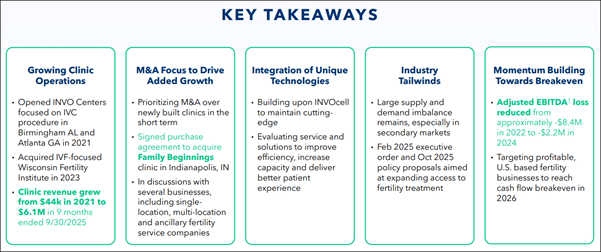

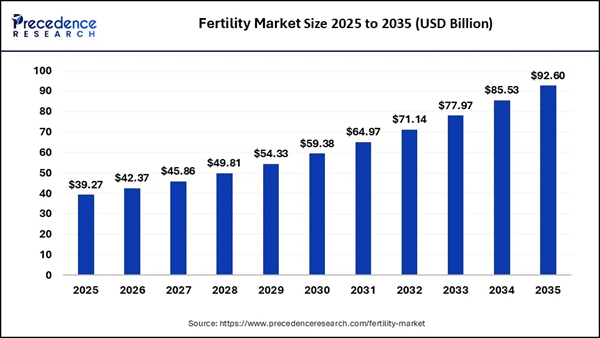

Friday's Watchlist | See Why (Nasdaq: IVF) Just Landed On Tomorrow's Radar Dear Reader, A major shift is unfolding across fertility care as more families search for treatment options that are both accessible and cost-conscious. Clinics are under growing pressure to meet rising demand without relying solely on expensive laboratory infrastructure. With the fertility market projected to more than double from $42B in 2026 to more than $92B by 2035, companies with scalable and differentiated care models could start drawing increased attention. Among them is INVO Fertility, Inc. (Nasdaq: IVF), a healthcare services company focused on expanding access to assisted reproductive technology through its proprietary medical device and growing network of fertility centers. This is just one of the reasons why (Nasdaq: IVF) just hit our radar and will be topping our watchlist tomorrow morning—Friday, March 13, 2026.

But keep in mind, (Nasdaq: IVF) has an incredibly small float with less than 2M shares listed as available to the public. When companies have small floats like this, the potential exists for big moves if demand begins to shift. In fact, one analyst, Jason McCarthy, Ph.D., Senior Managing Director at Maxim Group, recently set a $4 target on (Nasdaq: IVF), which suggests over 380% upside potential from this week's $.82 range.

That's what makes (Nasdaq: IVF) a name worth watching right now. To understand why, it helps to look at the company's care model, its proprietary technology, and the way it is building out its fertility clinic network. Redefining the Standard of Reproductive Care

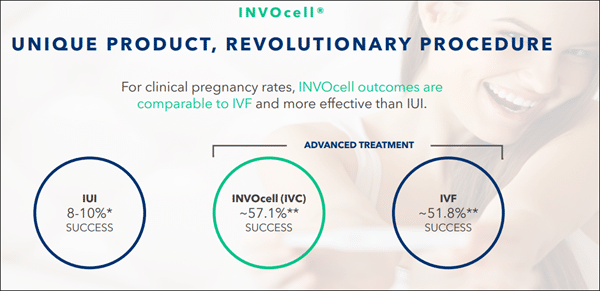

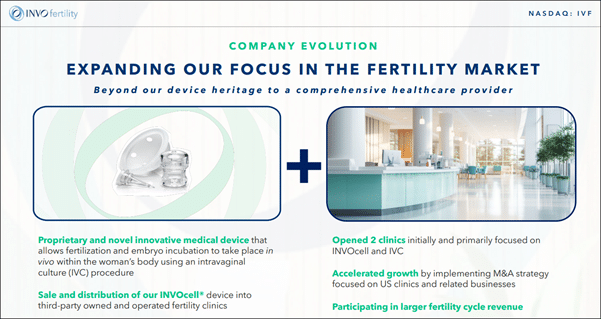

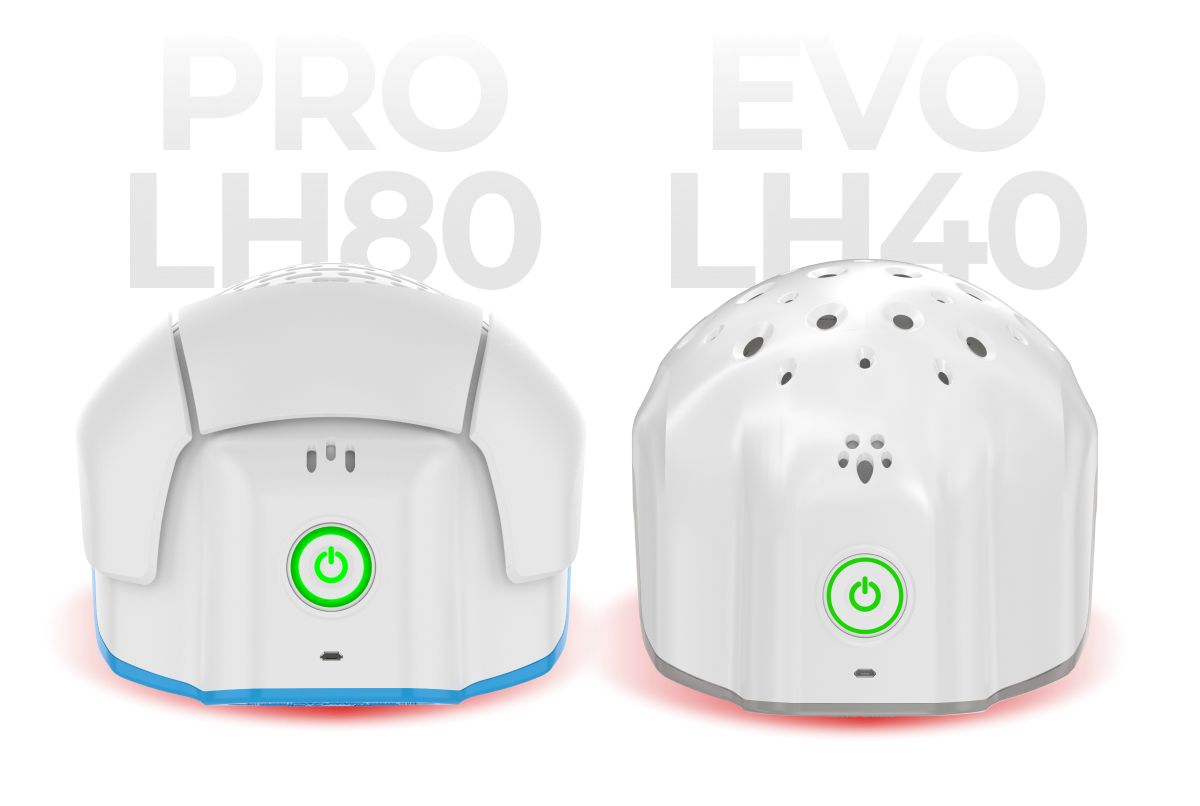

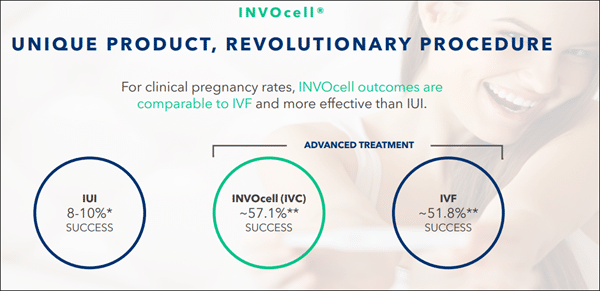

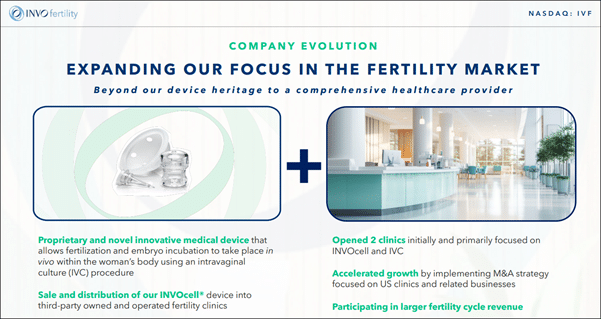

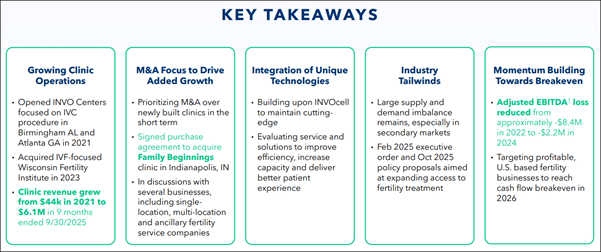

INVO Fertility, Inc. (Nasdaq: IVF) is a healthcare services company dedicated to expanding access to assisted reproductive technology ("ART") for patients in need. The company's primary commercial strategy focuses on building, acquiring, and operating profitable fertility clinics across the United States. Currently, the company manages four operational fertility clinics, including specialized "INVO Centers" that prioritize the intravaginal culture (IVC) procedure. These centers are designed to streamline the fertility process, reducing the reliance on expensive, high-overhead laboratory infrastructure while maintaining high success rates for patients. What distinguishes (Nasdaq: IVF) from traditional providers is the INVOcell® medical device, a revolutionary technology that allows fertilization and early embryo development to take place in vivo—within the woman's body—rather than in a conventional laboratory incubator.

This approach offers patients a more connected and intimate experience, often cited as a "natural" alternative to the more clinical nature of standard IVF. By allowing the patient's own body to provide the necessary environment for incubation, the company significantly lowers the costs associated with embryology labs. Beyond its own centers, the company continues to distribute INVOcell to third-party clinics, broadening the reach of this patented technology globally. The company recently reached a major milestone by closing the acquisition of Family Beginnings, an Indiana-based fertility clinic. This transaction is a key component of their growth strategy to integrate established, profitable clinics into their ecosystem. By combining traditional services with their unique IVC technology, (Nasdaq: IVF) is creating a comprehensive platform to address the diverse needs of the global fertility market.

Addressing a Potential $92B Global Market

The demand for fertility services is no longer a niche medical sector; it is a massive global industry facing significant supply-side constraints. With the market expected to grow at a compound annual rate toward a $92B valuation by 2035, the bottleneck remains the high cost and limited availability of high-end lab facilities. INVO Fertility, Inc. (Nasdaq: IVF) addresses this by offering a solution that requires less infrastructure than traditional methods, potentially opening the door for millions of patients who were previously priced out of care. In many regions, the "fertility gap" exists because patients live too far from major metropolitan medical hubs. The (Nasdaq: IVF) model allows for smaller, more efficient clinics to operate profitably in a wider range of geographic locations. Furthermore, the rising age of first-time parents and increased insurance coverage for fertility treatments are driving a surge in volume. As more employers include reproductive benefits in their compensation packages, the pool of eligible patients is expanding faster than the current clinical infrastructure can support. (Nasdaq: IVF) is positioning its "INVO Centers" as the high-efficiency answer to this capacity crisis, aiming to capture a larger share of the mid-market patient demographic.

Securing Intellectual Property through 2040

A critical component of the company's long-term value is its aggressive protection of its core technology. In February 2026, (Nasdaq: IVF) announced the issuance of a new patent for a modified version of the INVOcell device. This patent extends the company's intellectual property protection through 2040, ensuring nearly two decades of exclusivity for its "in vivo" incubation method. This long-term protection provides a stable foundation for the company to scale its distribution and clinic operations without immediate concern from generic competitors. This modified device is not just a legal shield; it represents iterative innovation aimed at improving ease of use for clinicians and comfort for patients. By refining the hardware that makes IVC possible, (Nasdaq: IVF) is reinforcing its moat within the ART industry. As the only company with an FDA-cleared device for intravaginal culture, this patent extension solidifies their monopoly on this specific, lower-cost category of advanced fertility care. Operational Excellence and Network Growth

Recent operational updates suggest that (Nasdaq: IVF) is focused on maximizing the revenue potential of its existing clinics. Their Wisconsin location recently joined the Progyny network, which significantly expands the clinic's reach to members with specialized fertility benefits. Progyny is a leading fertility benefits management company for self-insured employers, and being "in-network" means a massive influx of potential patients whose treatments are pre-authorized and covered. This move is a strategic "win" that validates the clinical quality of the (Nasdaq: IVF) facilities. Furthermore, the company is upgrading its clinical capabilities, recently adding time-lapse incubation technology to its Wisconsin facility. This advanced technology allows embryologists to monitor embryo development in real-time without removing them from the controlled environment of the incubator. These enhancements demonstrate a commitment to providing "cutting-edge solutions" that keep the company competitive with the nation's top-tier fertility labs. It shows that while (Nasdaq: IVF) is a leader in cost-effective care, they are not compromising on the high-tech standards required for successful outcomes. Management and Executive Realignment

To support this rapid phase of growth, INVO Fertility, Inc. (Nasdaq: IVF) has recently aligned its executive leadership structure. Terah Krigsvold has stepped in as CFO, while Andrea Goren has transitioned to the role of Chief Business Officer and CEO of INVO Centers LLC. This move is specifically designed to allow Goren to focus 100% of his efforts on the expansion and profitability of the company's clinic network. Having a dedicated CEO for the clinic division suggests that the company is moving away from being just a device manufacturer and is now a full-scale healthcare services operator. This structural shift is reflective of the company's shareholder letter issued in February, which highlighted a "strengthened fundamental position." The company is clearly moving from a research and development phase into a high-execution phase. By placing experienced leaders in roles that match their specific strengths in finance and business development, (Nasdaq: IVF) is signaling to the market that it is ready to handle the complexities of a multi-state clinical operation.

7 Reasons Why (IVF) Will Be Topping Our Watchlist Tomorrow Morning—Friday, March 13, 2026…1. Small Float: With fewer than 2M shares listed as publicly available, (Nasdaq: IVF) has an incredibly small float, which could witness the potential for big moves if demand begins to shift. 2. Analyst Target: Coverage from Maxim Group's Jason McCarthy, Ph.D. places a $4 target on (Nasdaq: IVF), which suggests over 380% upside potential from this week's $.82 range

3. Patent Protection: Intellectual property for the INVOcell device was recently extended through 2040, giving (Nasdaq: IVF) long-term protection around its intravaginal culture technology. 4. Clinic Expansion: The recent acquisition of Family Beginnings adds an established fertility clinic to the growing network being built by (Nasdaq: IVF). 5. Proprietary Device: The INVOcell system allows fertilization and early embryo development to occur within the patient's body, a differentiated approach that sets (Nasdaq: IVF) apart from traditional laboratory-based methods. 6. Insurance Access: A Wisconsin clinic operated by (Nasdaq: IVF) recently joined the Progyny network, expanding visibility to patients with employer-sponsored fertility benefits. 7. Industry Growth: Fertility care demand continues to rise globally, and (Nasdaq: IVF) operates in a sector projected to expand from $42B in 2026 to more than $92B by 2035. Get (Nasdaq: IVF) On Your Radar Before Tomorrow Morning…

Taken together, these developments help explain why (Nasdaq: IVF) has begun attracting increased attention. With fewer than 2M shares listed as publicly available, expanding clinic operations, and a proprietary device protected through 2040, the company is building a model that combines technology with a growing fertility care network. Add in new insurance access through the Progyny network, continued industry expansion toward a projected $92B market by 2035, and recent analyst coverage placing a $4 target on the company, and it becomes clear why many observers are starting to track (Nasdaq: IVF) more closely. We will have all eyes on (Nasdaq: IVF) tomorrow morning. Take a look at (Nasdaq: IVF) before you call it a night. Also, keep a lookout for my morning update. Have a good night. Sincerely, Gary Silver

Managing Editor,

Market Crux

|